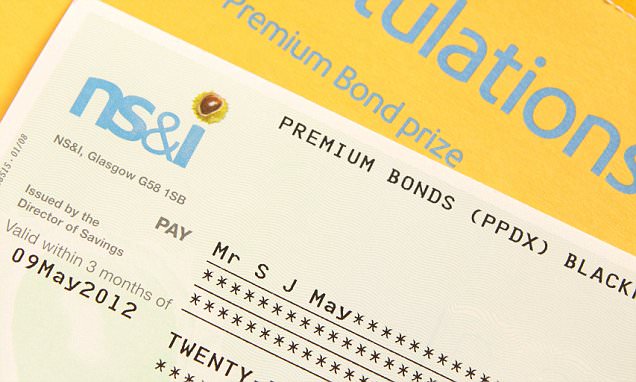

Savers wanting Premium Bonds will no longer be able to purchase them over the counter at the Post Office from August. The move comes after NS&I; faced heavy criticism earlier in the year as over 65s rushed to buy Pensioner Bonds, which offered market leading rates.